量化策略——50指数对冲

#获取股票数据并进行策略收益组合import akshare as ak

import pandas as pd

import numpy as np

import matplotlib

import matplotlib.pyplot as plt

import numpy as np

import matplotlib.pyplot as plot

import talib #计算均线的库,随便学一下,几分钟就懂

#获取50指数成分

index_stock_info_df = ak.index_stock_cons('000300')

stock_list = index_stock_info_df['品种代码']

star='20170117'

end="20230810"

last = pd.DataFrame()

last['trade_date'] = 0

last['strategy'] = 0

for i in stock_list:

#print(i)

try:

df = ak.stock_zh_a_hist(symbol=i, period="daily", start_date=star, end_date=end, adjust="")

df.rename(columns={"日期":'trade_date',"开盘":'open',"收盘":'close',"最高":'high',"最低":'low',"涨跌幅":'change'},inplace = True)

df = df.sort_index() #建立索引

df['ma10'] = df['close'].rolling(20).mean()

df['ma20'] = df['close'].rolling(60).mean()

#计算股票收益,有两种计算收益率方法:1.离散收益率 2.连续收益率

df['position'] = np.where(df['ma10'] > df['ma20'], 1, 0) #当20日均线大于60日均线时记录1,反之记录-1

df['returns'] = df['close']/df['close'].shift(1)-1 #连续收益率计算

#data['returns_dis'] = data['close']/data['close'].shift(1) - 1 #离散收益率计算

df['strategy'] = df['position'].shift(1)*df['returns']

df['trade_date']=pd.to_datetime(df.trade_date,format="%Y-%m-%d")

#print(df.head())

#df['code'] = i

#下面需将得到的收益ret序列变成按日期由低到高排列

#cum=df['strategy']+cum#等权重配置一篮子股票,计算权重和

last = pd.merge(df[['trade_date','strategy']],last,on='trade_date',how= 'left')

#last = last.set_index('trade_date')

#print(cum)

#print(last)

except:

continue

#(cum/len(stock_list)).cumsum().apply(np.exp).plot(figsize=(10, 6))

last = last.set_index('trade_date')

last = last.fillna(0)

last['Row_sum'] = last.apply(lambda x: x.sum(), axis=1)/len(stock_list)

last = last.reset_index()

last

#获取股指期货数据

df3 = ak.futures_main_sina(symbol="IF0")

df3.rename(columns={"日期":'trade_date',"开盘价":'open',"收盘价":'close',"最高价":'high',"最低价":'low'},inplace = True)

df3.sort_index()

#df3.index=pd.to_datetime(df3.trade_date,format="%Y-%m-%d")

df3 = df3[(df3['trade_date']>=datetime.date(2017,1,17))&(df3['trade_date']<=datetime.date(2023,8,13))]

df3['returns'] = df3['close']/df3['close'].shift(1)-1 #连续收益率计算

#data['returns_dis'] = data['close']/data['close'].shift(1) - 1 #离散收益率计算

df3['returns'].cumsum()

df3.trade_date=pd.to_datetime(df3.trade_date,format="%Y-%m-%d")

df3

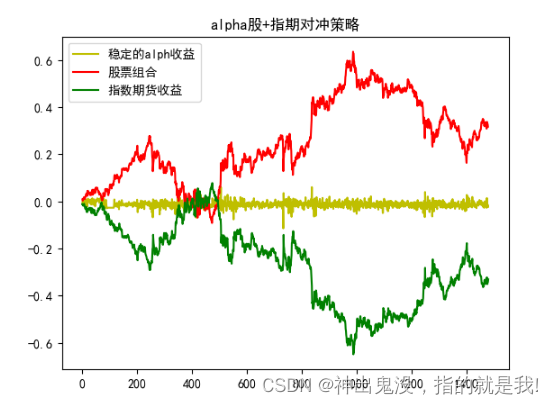

plt.plot(la.Row_sum.cumsum()-la.returns.cumsum(),label="稳定的alph收益",color="y")

plt.plot(la.Row_sum.cumsum(),label="股票组合",color='r')

plt.plot(-la.returns.cumsum(),label="指数期货收益",color='g')

plt.title("alpha股+指期对冲策略")

plt.legend()

#做空沪深300股指期货

#df3 = pro.fut_daily(ts_code='IF2012.CFX', start_date='20200411', end_date='20200812')

df3 = ak.futures_main_sina(symbol="IF0")

df3.rename(columns={"日期":'trade_date',"开盘价":'open',"收盘价":'close',"最高价":'high',"最低价":'low'},inplace = True)

df3.sort_index()

#df3.index=pd.to_datetime(df3.trade_date,format="%Y-%m-%d")

df3 = df3[(df3['trade_date']>=datetime.date(2010,4,13))&(df3['trade_date']<=datetime.date(2023,8,13))]

ret13=df3.close/df3.close.shift(1)-1

sy=pd.Series(1,index=df3.close.index)

sy2=ret13*sy.shift(1).dropna()

cum13=sy2.cumsum()

cum13 = cum13[-len(cum)-1:]

cum13 = pd.Series(list(cum13))

cum13 = cum13.sort_index()

#cum13 = (cum13.fillna(method='ffill'))

cum13 = (cum13.fillna(0))

# f=cum[-2]*250/len(df3.close)-cum13[-2]*250/len(df3.close)

# f1=100*f#换成百分制

#plt.plot(cum12,label="沪深300",color='b')

plt.plot(cum-cum13,label="稳定的alph收益",color="y")

plt.plot(cum,label="股票组合",color='r')

plt.plot(-cum13,label="指数期货收益",color='g')

plt.title("alpha股+指期对冲策略")

plt.legend()

#print("alpha年化收益率:{:.2f}%".format(f1))

df3 = ak.futures_main_sina(symbol="IF0")

df3.rename(columns={"日期":'trade_date',"开盘价":'open',"收盘价":'close',"最高价":'high',"最低价":'low'},inplace = True)

df3.sort_index()

#df3.index=pd.to_datetime(df3.trade_date,format="%Y-%m-%d")

df3 = df3[(df3['trade_date']>=datetime.date(2017,1,17))&(df3['trade_date']<=datetime.date(2023,8,13))]

df3['returns'] = df3['close']/df3['close'].shift(1)-1 #连续收益率计算

#data['returns_dis'] = data['close']/data['close'].shift(1) - 1 #离散收益率计算

df3['returns'].cumsum()

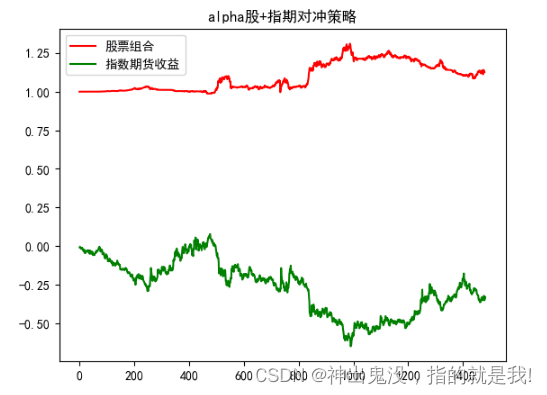

last = last.reset_index()

#plt.plot((last['Row_sum']+1).cumprod()-df3['returns'].cumsum(),label="稳定的alph收益",color="y")

plt.plot((last['Row_sum']+1).cumprod(),label="股票组合",color='r')

plt.plot(-df3['returns'].cumsum(),label="指数期货收益",color='g')

plt.title("alpha股+指期对冲策略")

plt.legend()

郑重声明: 本文只是个人(本单位)复盘记录,文内提到的所有信息仅为分享和盘面结构梳理,不构成投资或投机建议,买卖自行决策,结果自己负责。

购买点数和充值VIP全部支持支付宝或微信扫码支付,登陆会员中心侧面板>>财务选择相关操作即可。

在线预览主旨方便移动设备使用和临时查看,直观浏览,对需要的文章再下载,预览了的文件且能秒速下载。

阅读与下载说明

1.『会员阅览(扣点)』为普通会员扣点(1元=1点)通道,已浏览过的只扣一次。

2.『VIP阅览 (VIP)』 为VIP特权通道,充值成VIP用户直接无任何限制高速在线阅览,VIP会员分包月,包年和终身VIP三种。

3.『免费阅览(免费)』为未付费会员通道,可无任何限制免费阅览该资源,推荐购买点数或充值VIP,以获取超值资源。

4. 阅览的资讯文件过大,根据您的网速而会有相应的延迟,请耐心等待;如果提示其他问题请联系客户解决。

购买点数和充值VIP全部支持支付宝或微信扫码支付,登陆会员中心侧面板>>财务选择相关操作即可。

在线预览主旨方便移动设备使用和临时查看,直观浏览,对需要的文章再下载,预览了的文件且能秒速下载。